JUPITER, Florida (May 8, 2021) – It’s now common knowledge that rounds played surged in 2020, and most know we’re off to a good start this year.

The National Golf Foundation has noted previously that on-course participation experienced its biggest net increase in 17 years. Off-course participation, meanwhile, continued its impressive run in 2020 by more than doubling the noteworthy gain that was seen on-course. NGF estimates there were just over 24 million off-course participants last year; just shy of the number of on-course golfers.

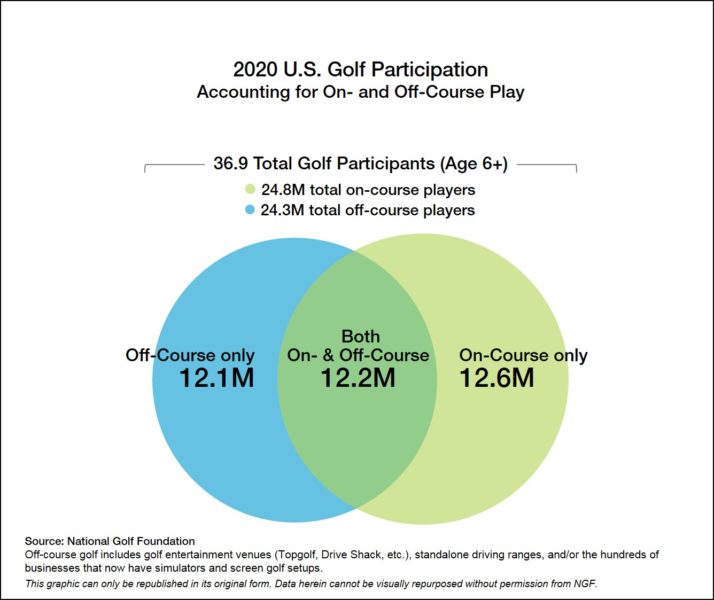

Golf’s overall participation base in the U.S. – combining on- and off-course players – rose 8% in 2020 to 36.9 million. This leaves us with three closely-sized and mutually-exclusive groups of Americans (age 6+):

- 12.6M who played only on-course golf (average age 50/29% female)

- 12.2M who played on AND off-course golf (average age 42/21% female)

- 12.1M who played only off-course golf (average age 31/45% female)

As you can see in the above chart, the total number of off-course golfers (Topgolf, ranges, simulators, etc.) has just about matched the number who play on a course. And it won’t be long before traditional, “green grass” participants are out-numbered. Very likely this year.

This is good news for golf. Our research tells us that the approachable, non-intimidating environments of Topgolf, and venues like it, help to cultivate interest in the traditional game.

Course operators in proximity to these golf entertainment venues should be doubling down on their marketing and player development investments, as there are an increasing number of customer prospects being generated right in their backyards.