JUPITER, Florida – As mask mandates fade, borders reopen and the threat of Covid-19 wanes, it appears the travel industry has finally hit an inflection point and is primed for a big summer – perhaps its biggest ever, according to travel industry leaders.

TSA throughput data is approaching pre-pandemic numbers (91% as of Wednesday, based on a seven-day rolling average), while the World Travel & Tourism Council (WTTC) updated its economic modeling in February and projects U.S. travel and tourism will exceed pre-pandemic levels by six percent.

So, what about golf travel, a robust $20 billion business in the U.S.? The indications are every bit as bullish.

This past week we surveyed golf travelers and resort operators to gauge what lies ahead. In both cases, there’s evidence that the so-called “revenge travel” sentiment is, in fact, a real thing. Roughly 80% of Core golfers suggest they have plans to take a golf-specific trip in 2022, up from two-thirds a year ago. Data from U.S. golf resorts validates this finding – 75 facilities reported to us that advanced bookings are up, on average, about 12% over the same period last year and almost 20% over pre-pandemic.

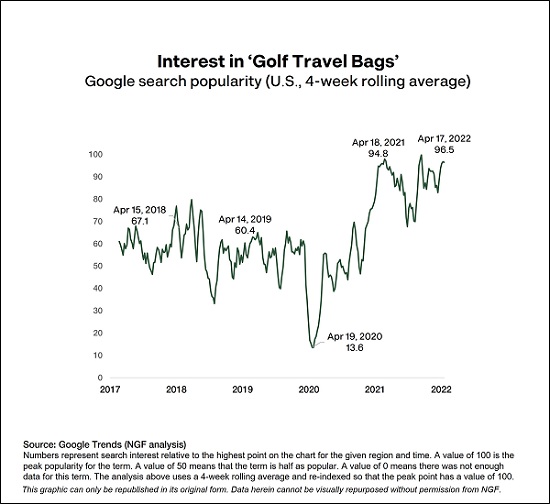

There are other positive signals, too, including the online search popularity index for ‘golf travel bags’, which sits about 30 points higher today compared to 2018 and 2019 (based on 4-week rolling averages). Whichever way you look at it, demand for golf travel seems to be bubbling up.

Of course, like most things, there’s a flip side to consider. First, travel rounds aren’t necessarily incremental – some of them are just transferred from local markets to resorts (although anyone who’s been on a golf getaway surely knows the quantity of golf tends to increase).

There’s also the reality that a surge in leisure travel in general poses a threat to demand for golf rounds, goods, and services, as it competes for the same time, money, and attention from golf consumers. This summer should be golf’s biggest “back to normal” stress test to-date.

As we turn the page to May, there remains a lot of optimism across the golf industry, particularly for golf destinations that didn’t enjoy as much of the “surge” seen elsewhere during the early days of golf’s pandemic-fueled boom. It appears their dividend is on its way.