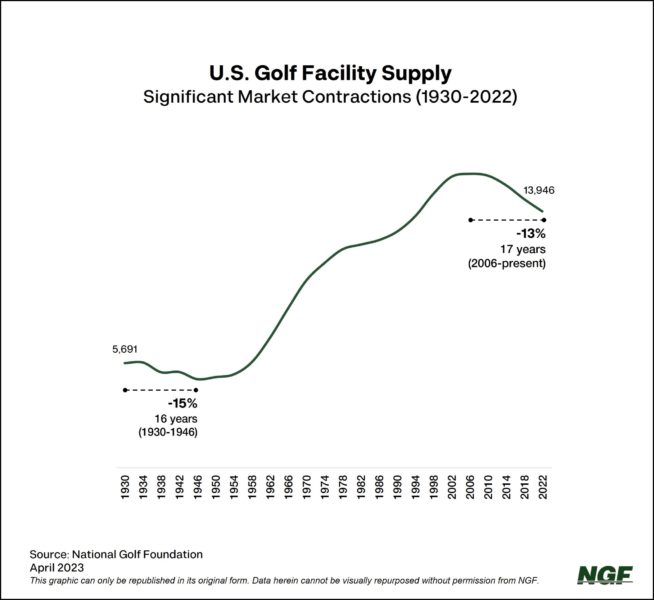

JUPITER, Florida – Only twice in the history of golf in the United States has there been a sustained contraction in golf course supply. One period coincided with The Great Depression and the other (today’s) began with the implosion of the real estate market and was supercharged by The Great Recession.

In contrast, there have been three periods of sustained expansion of supply: the 1920s, 1960s and 1990s. The Roaring Twenties, a period of affluence and aspirations, saw a steady increase in the number of private golf clubs catering to the Jay Gatsbys of the time.

The Sixties, known mostly for its counterculture mien, saw the democratization of golf, when demand from a growing middle class drove the development of public courses across the nation.

Finally, there was the Nineties Golf Boom, fueled by real estate development and entrepreneurs trying to cash in on golf.

Golf’s two contraction periods began and ended in very different ways.

The Great Depression remains the greatest economic disaster in American history. At its height in the mid-1930s, unemployment reached 25% and even those who kept their jobs experienced a 40+% drop in income. Businesses of all sorts, including golf courses, failed in unprecedented numbers. (The NGF was formed in the middle of that chaotic period to address some of the industry’s challenges.) It took a World War to pull the nation out of the depression, and the post-war prosperity of the Industrial Era to end golf’s first contraction.

Golf’s second supply ‘resizing’ that began in 2006 is now, finally, coming to an end. Thank goodness. With all the attention paid to year-over-year golf course closures, it’s understandable why some observers characterized this contraction as a ‘death knell’ for golf. We’ve always seen it differently.

If you look at golf supply objectively, and with a longer view, it’s clear golf is in a better place today than it was when the current ‘supply correction’ began.

Since 2006, there’s been a net decline of about 2,200 18-hole equivalent courses, or roughly 13% of the world’s richest national supply. But consider that over the same period:

550+ new 18-HEQ courses opened

1,500+ reconstructions and/or major renovations were completed

250+ golf courses were ‘resurrected’

Note that reconstructions and ‘resurrections’ are not reported as new course development by NGF, even though a number of these are so comprehensive they’re in essence entirely new courses.

What’s a golf course ‘resurrection’? While not an official category in our facility database, we track instances in which a facility is closed (seemingly for good) and then gets new life. A prime example is the former West Palm Beach municipal course. It closed in 2018 after falling into disrepair and the town entertained proposals that would have turned it into condominiums or townhomes. But golf – a golf park, actually – reopened this week at that city-owned site, overhauled by Gil Hanse and operated on a non-profit basis by the PGA of America.

So, if someone asks you if golf is ‘going to make it’, please tell them the supply contraction we’ve just gone through was necessary and good for the game and business of golf. Provide the context that we added almost 5,000 18-HEQ over the 20 years leading up to the correction, and from a long-term perspective, we are net positive in supply.

Also mention that in addition to an improved supply/demand balance we have a higher quality supply of courses and they are, overall, in better financial shape than ever. Oh, and we’ve added more than 1,000 off-course facilities – like golf entertainment and simulator venues – that are drawing new participants to game.

It took a world war to end the first of golf’s ‘corrections,’ and a pandemic to end the second.