Entering 2025, 81% of U.S. golfers were feeling optimistic about the economy, a major leap with how participants felt in 2023.

That’s just one of the illuminating takeaways from Buffalo Groupe’s February release of the “2024 Golf Travel Study Marketplace Report: 2025 Edition.” In its annual report, the company analyzed the state of golf travel among U.S. players in 2024.

One of the major takeaways of the report was confidence U.S. golfers have in the current economic climate. The study revealed a healthy 16% jump — from 5% to 21% — since the previous report.

The study’s objectives also included past golf travel behaviors, future travel intentions and golfer-focused metrics.

The study’s objectives also included past golf travel behaviors, future travel intentions and golfer-focused metrics.

This past fall, 736 participants were surveyed. Qualified respondents must have golfed in the past year, taken a golf trip in the last five and have completed one or more golf-focused getaways.

For more than 20 years, the Longitudes Group, now the research division of Buffalo Groupe, has done abundant golf-focused research. Buffalo Groupe CEO Kyle Ragsdale says the genesis for the current version of the report is important because it’s driven by its marketing agency operation, which works closely with global golf travel and tourism entities.

“We’re helping our clients, which include nearly 40 resorts and destinations, understand demand, segment their markets and analyze who’s doing what in the golf industry,” Ragsdale says. “This research and insight are crucial to the services we provide.”

Key findings:

• A particular course and its availability steered trip preferences

• Scotland and Ireland continued to be the most frequented destinations, with results showing they’ll continue as favorited spots

• Domestically, the Southeast remained the No. 1 desired golf region by more than half of travelers

• High- and low-budget travelers indicated cost was a factor and will continue to be

• Ease-of-booking package deals were most preferred

• Social media trends changed from the previous year

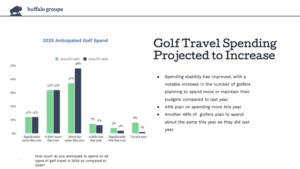

The biggest change from last year’s survey correlated more favorably to feelings about the economy. Overall, roughly one in five surveyed professed to be financially confident in the economy. Fewer travelers indicated they were going to spend less than the previous year on golf trips compared to years past.

Bolstered by the feedback, Ragsdale views it less as a political statement post U.S. presidential election but more so as a restart.

“It’s a massive sigh of relief, now that the election is over, but as clarity around what they feel [the economy] might look like,” he says. “Consumer sentiment and confidence in the economy has definitely ticked up and you see it there.”

Therein lies the report’s correlation between optimism and respondents’ sentiment to consider more golf travel in 2025.

“Golf is a sport you can play forever, for your entire life. The interest is at an all- time high or near an all-time high; it’s not going anywhere,” says Ragsdale.